Independent Financial Advisors Wales: Optimizing Your Financial Future

In today's fast-paced world, financial planning is essential for securing a prosperous future. Many individuals and families in Wales are increasingly turning to independent financial advisors to navigate the complexities of personal finance and investments. This article delves into the benefits of working with these experts, as well as key services they offer.

Understanding the Role of Independent Financial Advisors

Independent financial advisors (IFAs) in Wales play a crucial role in helping clients make informed financial decisions. Unlike advisors affiliated with a specific financial institution, IFAs offer unbiased advice based on their clients' best interests. They provide a wide range of services, including:

- Investment Planning: Tailoring investment strategies to align with individual goals.

- Pension Advice: Helping clients plan for retirement through effective pension schemes.

- Tax Planning: Structuring finances to minimize tax liabilities and enhance returns.

- Estate Planning: Assisting clients in managing and distributing their estate efficiently.

- Insurance Services: Finding the right coverage to protect against unforeseen events.

The Importance of Personal Financial Planning

Effective financial planning is vital for both short-term and long-term goals. Whether it’s saving for a home, planning for retirement, or establishing a college fund, having a clear, actionable financial plan can make a significant difference. Here are some reasons why engaging an independent financial advisor in Wales is beneficial:

- Personalized Strategies: Every financial situation is unique. A qualified advisor will develop a tailored strategy that addresses your specific needs.

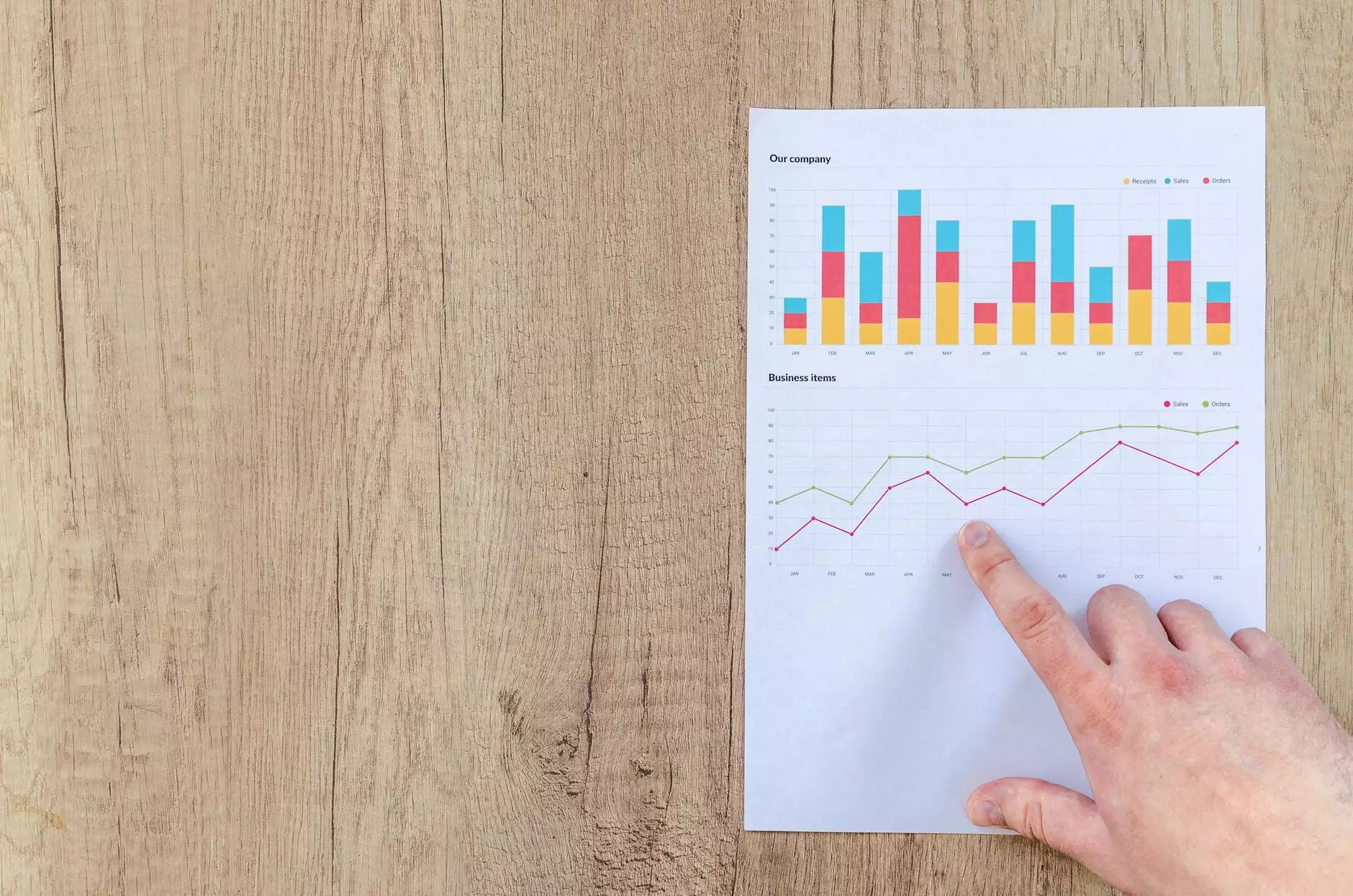

- Expert Knowledge: Financial markets can be complex and ever-changing. Advisors possess the skills and expertise to provide up-to-date information and analysis.

- Ongoing Support: Financial planning is not a one-time event. Independent advisors offer continuous support, monitoring investment performance and adjusting strategies as needed.

- Goal Achievement: A structured financial plan helps you stay focused on your goals, making achieving them more likely.

Choosing the Right Independent Financial Advisor in Wales

When selecting an independent financial advisor in Wales, it is crucial to consider several factors to ensure you make the right choice:

1. Qualifications and Credentials

Verify that the advisor holds relevant qualifications such as Chartered Financial Planner or Certified Financial Planner (CFP) status. These designations indicate a high level of expertise.

2. Fee Structure

Understanding how an advisor charges for their services is essential. Some may work on a commission basis, while others charge a fee for their time and advice. Be sure to clarify this upfront.

3. Client References

Ask for references or testimonials from previous clients. A reputable advisor should be proud to share their success stories and client satisfaction rates.

4. Communication Style

Your advisor should be someone you feel comfortable communicating with. Ensure their approach aligns with your expectations and preferences.

5. Specialization

Some advisors specialize in specific areas such as retirement planning, tax strategies, or investments. Finding an advisor whose expertise aligns with your needs is beneficial.

Common Services Offered by Independent Financial Advisors

Independent financial advisors provide a broad spectrum of services tailored to various financial needs:

Investment Services

Investment management is a core component of an advisor's role. They help clients choose the right investment vehicles, considering factors like risk tolerance, time horizon, and financial objectives. This could include:

- Mutual Funds

- Exchange-Traded Funds (ETFs)

- Stocks and Bonds

- Real Estate Investments

Pension and Retirement Planning

With retirement looming for many, having a solid pension plan is critical. IFAs assist in:

- Evaluating Existing Pension Schemes

- Establishing New Pension Contributions

- Calculating Retirement Needs

- Exploring Annuities

Tax Optimization Strategies

Working with an advisor can help in implementing various tax strategies to maximize your investment returns while minimizing tax liability. This includes:

- Utilizing Tax-Advantaged Accounts

- Tax-Loss Harvesting

- Income Splitting Strategies

Estate and Inheritance Planning

A crucial, yet often overlooked, aspect of financial planning is estate management. An independent advisor can help you with:

- Creating Wills and Trusts

- Utilizing Life Insurance as a Strategy

- Minimizing Estate Taxes

The Future of Financial Advisory in Wales

As technology continues to evolve, so too does the financial advisory landscape. More clients in Wales are embracing digital platforms, allowing for enhanced communication and efficiency. The use of financial planning software makes it easier for advisors to create detailed financial plans, perform risk analyses, and offer personalized advice.

Moreover, the rise of robo-advisors poses a question for traditional advising methods. However, the value of human connection and tailored advice remains unmatched. Independent financial advisors in Wales are positioned uniquely to leverage technology while offering personalized, empathetic service that robots simply cannot replicate.

Final Thoughts

Engaging with an independent financial advisor in Wales can be one of the most empowering decisions you make for your financial future. They not only help you navigate the intricacies of your finances but also work consistently toward your goals, ensuring you have the resources you need to achieve your dreams.

As you consider your financial future, take the time to research and choose an independent financial advisor that aligns with your vision and values. By doing so, you'll put yourself on a path to financial stability and success that can last a lifetime.

Contact Us for More Information

If you're ready to take charge of your financial future, consider reaching out to Roberts Boyt. Visit our website robertsboyt.com today to learn how our independent financial advisors can assist you in making the most of your finances.

independent financial advisors wales